RI Health Insurance Mandate

Health insurance is a requirement in the state of Rhode Island.

If you go without continuous health coverage, you might pay a penalty when you file your Rhode Island income taxes. See below for more information about the health insurance mandate and how it might affect you.

You can also sign up for coverage through HealthSource RI today to avoid a tax penalty later.

Hardship Exemption

Hardship exemptions are available by applying through HealthSource RI. The application is available in English and Spanish. More information is available below.

Additional exemptions (non-hardship) are available through the Rhode Island Personal Income Tax return. If you are looking for more information about additional exemptions from the penalty fee, please see the exemptions section below.

What is the “mandate”?

The mandate is a requirement that all non-exempt Rhode Islanders have qualifying health coverage. Sources of qualifying health coverage include coverage through their employer or purchased directly from a health insurance carrier, Medicare, Medicaid, or a health plan purchased through HealthSource RI, the state’s health exchange. Failure to have coverage may result in a state personal income tax-time penalty.

Who does this apply to?

All Rhode Islanders are required to have qualifying health coverage, unless they are otherwise exempt (see Exemptions Section).

When does the mandate take effect?

Rhode Island’s mandate went into effect on January 1, 2020.

Where did the mandate come from?

The Affordable Care Act, approved by Congress and signed into law by then-President Barack Obama in March 2010, required most Americans to have health care coverage or pay a penalty per family member on their federal income tax return. Exemptions to that requirement were available for certain people who qualified.

Through the federal Tax Cuts and Jobs Act, the federal penalty for not having health coverage after January 1, 2019 was reduced to $0. The penalty was still in effect for the entire year in 2018.

Legislation passed by the General Assembly and signed by Governor Gina M. Raimondo on July 5, 2019, enacts the requirement and penalty here in Rhode Island. This law requires all non-exempt members of your household to have health coverage starting in January 2020.

If you do not have coverage and do not qualify for an exemption, you will be assessed a penalty when filing personal income taxes for the state of Rhode Island.

Why is Rhode Island establishing this mandate?

In 2024, over 97% of Rhode Islanders have health coverage. The reduction of the federal mandate penalty to $0 led Rhode Island to enact a state level mandate. This is an important tool in keeping Rhode Islanders covered and maintaining their access to affordable health care for when they need it.

Does the Rhode Island mandate apply to residents of other states?

No. No penalty will be imposed on any individual for any month during which the individual is a legal resident of another state. The penalty will apply only to Rhode Island residents – and to part-year Rhode Island residents for the period during which they were Rhode Island residents.

Are there any exceptions to the mandate to have health coverage?

Generally, a penalty will be assessed when individuals go without coverage. There are some exceptions to this rule, however, and they are called exemptions. See below for more detail about exemptions available.

What exemptions are available and where do I apply for an exemption?

Exemptions can be claimed in one of two ways, depending on the exemption type. It is important to know that some exemptions are claimed through a Rhode Island personal income tax filing, and others are requested through an application submitted to HealthSource RI (please refer to the table below).

Exemptions granted by the RI Division of Taxation will be claimed through personal income tax Form RI-1040 for RI residents and Form RI-1040NR for part-year RI residents. There is no separate application process. The following exemptions will be available:

| Exemption | Description | How to Claim or Apply for Exemption |

| Hardship | You experienced a hardship that prevented you from obtaining coverage under a qualified health plan. See below for more information. |

Apply through HealthSource RI |

| Members of certain religious sects | You are a member of a recognized religious sect. | Apply through HealthSource RI |

| Coverage considered unaffordable based on projected income | HealthSource RI determined that you didn’t have access to coverage that is considered affordable based on your projected household income. | Apply through HealthSource RI |

| Certain Medicaid programs that are not minimum essential coverage | You were (1) enrolled in Medicaid coverage provided to a pregnant woman that isn’t recognized as minimum essential coverage; (2) enrolled in Medicaid coverage provided to a medically needy individual that isn’t recognized as minimum essential coverage; or (3) enrolled in Medicaid coverage provided to a medically needy individual and were without coverage for other months because the spend-down had not been met. | Apply through HealthSource RI |

| Part-year Rhode Island Resident | You were a bona fide resident of another state for part of the year and are exempt for months in which you were not a Rhode Island resident. | Claimed on RI Personal Income Tax Return |

| Members of a health care sharing ministry | You were a member of a health care sharing ministry. | Claimed on RI Personal Income Tax Return |

| Members of Indian tribes | You were either a member of a federally recognized Indian tribe, including an Alaska Native Claims Settlement Act (ANCSA) Corporation Shareholder (regional or village), or you were otherwise eligible for services through an Indian health care provider or the Indian Health Service. | Claimed on RI Personal Income Tax Return |

| Incarceration | You were in a jail, prison, or similar penal institution or correctional facility after the disposition of charges. | Claimed on RI Personal Income Tax Return |

| Aggregate self-only coverage considered unaffordable | Two or more family members’ aggregate cost of self-only employer-sponsored coverage was more than 9.02% of household income for 2025[1], as was the cost of any available employer-sponsored coverage for the entire family. | Claimed on RI Personal Income Tax Return |

| Member of tax household born or adopted during the year | The months before and including the month that an individual was added to your tax household by birth or adoption. You should claim this exemption only if you also are claiming another exemption on your Rhode Island Personal Income Tax return. | Claimed on RI Personal Income Tax Return |

| Member of tax household died during the year | The months after the month that a member of your tax household died during the year. You should claim this exemption only if you also are claiming another exemption on your Rhode Island Personal Income Tax return. | Claimed on RI Personal Income Tax Return |

| Citizens living abroad and certain noncitizens |

You were: • A U.S. citizen or a resident alien who was physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months; • A U.S. citizen who was a bona fide resident of a foreign country or countries for an uninterrupted period that includes the entire tax year; • A bona fide resident of a U.S. territory; • A resident alien who was a citizen or national of a foreign country with which the U.S. has an income tax treaty with a nondiscrimination clause, and you were a bona fide resident of a foreign country for an uninterrupted period that includes the entire tax year; • Not lawfully present in the U.S. and not a U.S. citizen or U.S. national. For this purpose, an immigrant with Deferred Action for Childhood Arrivals (DACA) status is not considered lawfully present and therefore qualifies for this exemption. For more information about who is treated as lawfully present in the U.S. for purposes of this coverage exemption, visit HealthCare.gov; or • A nonresident alien, including (1) a dual-status alien in the first year of U.S. residency and (2) a nonresident alien or dual-status alien who elects to file a joint return with a U.S. spouse. This exemption doesn’t apply if you are a nonresident alien for the tax year, but met certain presence requirements and elected to be treated as a resident alien. For more information, see Pub. 519. |

Claimed on RI Personal Income Tax Return “Code C” |

[1] Indexed annually by Federal regulation.

How do I apply for an exemption through HealthSource RI?

The exemption application through HealthSource RI is available here. Please review and complete the application, if needed. Application submission instructions are found at the end of the application. If you have questions, call HealthSource RI at 855-840-4774.

Please refer to the table below for more information about exemptions processed by HealthSource RI.

| Exemption Reason | Documentation Required | Application Timing |

| You’re a member of a recognized religious sect with religious objections to insurance, including Social Security and Medicare | The name and address of the religious sect. If available, a copy of an approved IRS Form 4029 (“Application for Exemption from Social Security and Medicare Taxes and Waiver of Benefits”). | You may apply at any time. |

| You have experienced a “hardship” that affects your ability to purchase health insurance coverage (see list of Hardship reasons) | See hardship reasons and documentation in table on the exemption application. |

You may apply before, during or after the hardship, depending on the circumstances. Applications must be made during the calendar year in which the hardship occurred. |

| The lowest-priced coverage available to you would cost more than 8.05% of projected household income for 2026[2] | Application eligibility results or information about any job-related health insurance available to family (including lowest price plan available through employer.) |

You must apply for this exemption by the last day on which you can sign up for available coverage for that plan year. This day would either be the last day of Open Enrollment for that plan year or the last day of a special enrollment period, if you qualify. You can only be exempt for the months after you apply. Note: A similar affordability exemption can be claimed retroactively on your tax return. |

[2] Indexed annually by Federal regulation.

What is considered a “hardship”?

You can receive a hardship exemption through HSRI for yourself or another member of your tax household for the applicable tax year if you experienced a hardship that prevented you from obtaining minimum essential coverage. Hardship exemptions usually cover the month before the hardship, the months during which the hardship is experienced, and the month after the hardship has occurred.

Please refer to the chart in the exemption application for examples of hardship exemptions. For these exemptions, you will need to include documents that support your application. If you can’t obtain the documents, call HealthSource RI at 1-855-840-4774.

What is considered “affordable” health coverage?

A job-based health plan covering only the employee that costs 9.86% or less of the employee’s household income is considered “affordable.”

• For the employee, affordability is based on only the premium you’d pay for self-only (individual) coverage.

• For other members of the household (not the employee), affordability is based on the premium amount to cover everyone in the household.

• The employee’s total household income is used. Total household income includes income from everybody in the household who’s required to file a tax return.

If a job-based plan is “affordable,” and meets the “minimum value” standard, you’re not eligible for premium tax credits through HealthSource RI. More information is available here.

What if HealthSource RI denies my request for an exemption?

If HealthSource RI denies your request for an exemption, you will receive a denial notice and may file an appeal. Appeals must be filed within 30 days of the denial notice. Please review the denial notice for instructions on how to file an appeal.

What is a "qualified health plan"?

An insurance plan that’s certified by HealthSource RI, provides essential health benefits, follows established limits on cost-sharing (like deductibles, copayments, and out-of-pocket maximum amounts), and meets other requirements under the Affordable Care Act. All qualified health plans meet the Affordable Care Act requirement for having health coverage, known as “minimum essential coverage.”

What is Minimum Essential Coverage?

The law requires all non-exempt Rhode Islanders to have minimum essential coverage. Any of the following types of coverage count as minimum essential coverage:

• An employer-sponsored health coverage plan (including self-insured plans, COBRA coverage and retiree coverage);

• A health plan offered in the individual market, including a qualified health plan offered by HealthSource RI, the state’s health insurance exchange; health coverage offered by certain student health plans; and catastrophic coverage;

• The federal Medicare health coverage program, including coverage under Medicare Part A and coverage under Medicare Advantage plans;

• The state Medicaid program;

• The government’s Children’s Health Coverage Program (CHIP);

• The TRICARE program (which generally applies to the military);

• Certain types of veterans’ health coverage administered by the U.S. Department of Veterans Affairs (sometimes called the Veterans Administration, or VA);

• Health plans related to Peace Corps volunteers;

• Coverage under the Department of Defense Non-appropriated Fund Health Benefit Program;

• Refugee Medical Assistance supported by the Administration for Children and Families;

• Coverage under an expatriate health plan;

• Self-funded health coverage offered to students by universities (if the sponsor of the program has applied to the U.S. Department of Health and Human Services to be recognized as minimum essential coverage);

• Other coverage recognized by the U.S. Secretary of Health and Human Services as minimum essential coverage.

Are there any types of health-related coverage that do not count for the purposes of Rhode Island’s new mandate?

The following types of coverage are not considered minimum essential coverage:

• Limited-scope dental benefits;

• Limited-scope vision benefits;

• Benefits for long-term care, nursing home care, home health care, community-based care, or any combination of these;

• Coverage only for a specific disease or illness;

• Hospital indemnity or other fixed indemnity coverage;

• Medicare supplemental health coverage;

• Any other similar benefits that are limited in scope.

You or members of your household may incur a penalty if they do not have “minimum essential coverage”, even if you have coverage under one or more, or any combination, of the following:

• Coverage only for accident, or disability income coverage, or any combination of those;

• Coverage issued as a supplement to liability coverage;

• Liability coverage, including general liability coverage and automobile liability coverage;

• Workers’ compensation or similar coverage;

• Automobile medical payment coverage;

• Credit-only coverage;

• Coverage for on-site medical clinics; and

• Other similar coverage under which benefits for medical care are secondary or incidental to other coverage benefits.

Are most Rhode Islanders already covered?

Yes, most Rhode Islanders have health coverage already. By maintaining health coverage throughout the year, members of your household can avoid the penalty.

How will I show that I have health coverage to avoid a penalty?

Most taxpayers have qualifying health coverage for all 12 months in the year. Therefore, they will simply check a box on the Rhode Island return, indicating that they had coverage for the previous calendar year, just as they checked a box on the federal return in prior years. Proof of insurance documents (such as Form 1095) should be retained and kept with your tax records for future reference. These documents may need to be supplied upon request.

For more information about coverage for part of the year, please see the questions about the tax penalty below.

What is HealthSource RI? Can HealthSource RI help me get health coverage and avoid the penalty?

HealthSource RI is Rhode Island’s health insurance marketplace. HealthSource RI helps individuals, families, and small businesses shop for and enroll in affordable health coverage. It was created under the federal Affordable Care Act (sometimes referred to as Obamacare) enacted in 2010.

Qualifying for coverage through HealthSource RI depends on your expected income, household size, access to health coverage through an employer, and other information. Some Rhode Islanders and their families may also qualify for federal financial assistance to help purchase coverage.

If you purchase health coverage through HealthSource RI:

• It will count for purposes of Rhode Island’s mandate and will exempt you from Rhode Island’s tax penalty.

• You may be eligible for a federal tax credit – which will reduce the cost of your premium.

• You can also find out if you qualify for coverage at no cost to you through the Medicaid program.

HealthSource RI can assist you in determining if you and your family qualify for low or no cost health coverage or federal financial assistance to help make your health coverage more affordable.

If you would like to know more, contact HealthSource RI using our live web chat or by phone at 1-855-840-4774.

Please remember, all health coverage that qualifies as minimum essential coverage satisfies the mandate.

When will I get penalized if I don’t have health coverage?

If you (or your dependents) do not have health coverage during a calendar year, a penalty will be assessed through the Rhode Island personal income tax return that you file for that specific year.

How much is the penalty?

The fee is calculated either as 2.5% of your yearly household income or per person ($695 per person and an additional $347.50 per child under age 18), whichever amount is higher.

• Using the percentage method, only the part of your household income that’s above the yearly tax filing requirement (as defined below) is counted.

• Using the per person method, you pay only for people in your household who don’t have insurance coverage.

If the income percentage method is higher, the maximum penalty can be no more than the cost of the total annual premium for an average bronze plan sold through HealthSource RI.

What if I (or someone in my family) only had coverage for part of the year?

If you have coverage for part of the year, the fee is 1/12 of the annual amount for each month you (or your tax dependents) don’t have coverage. One short gap in coverage does not count against you. If you’re uninsured only 1 or 2 consecutive months, you don’t have to pay the fee at all.

What happens if I do not file taxes, but my income exceeds the tax filing threshold?

What happens if I do not file taxes, but my income exceeds the tax filing threshold?

If you fail to file a Rhode Island personal income tax return and you have a balance due, you will be subject to a late-filing penalty, late-payment penalty, and interest that currently accrues at a rate of 18%. The Division of Taxation will issue a bill.

If I am assessed a penalty, can I enroll in coverage through HealthSource RI?

If a person is eligible to enroll through HSRI and is assessed a penalty, that person will be eligible for a special enrollment period (SEP) under R.I. Gen. Laws § 42-157-12. The tax filer will have sixty (60) days from the date he or she is assessed a penalty to complete enrollment in a health plan through HealthSource RI for the current year. Click here for more information.

What happens if the federal mandate penalty is reinstated?

If the federal mandate is again enforced through a comparable penalty, Rhode Island’s mandate penalty will no longer be assessed, under R.I. Gen. Laws § 44-30-101(j).

What happens if my family income falls below the tax filing threshold?

What happens if my family income falls below the tax filing threshold?

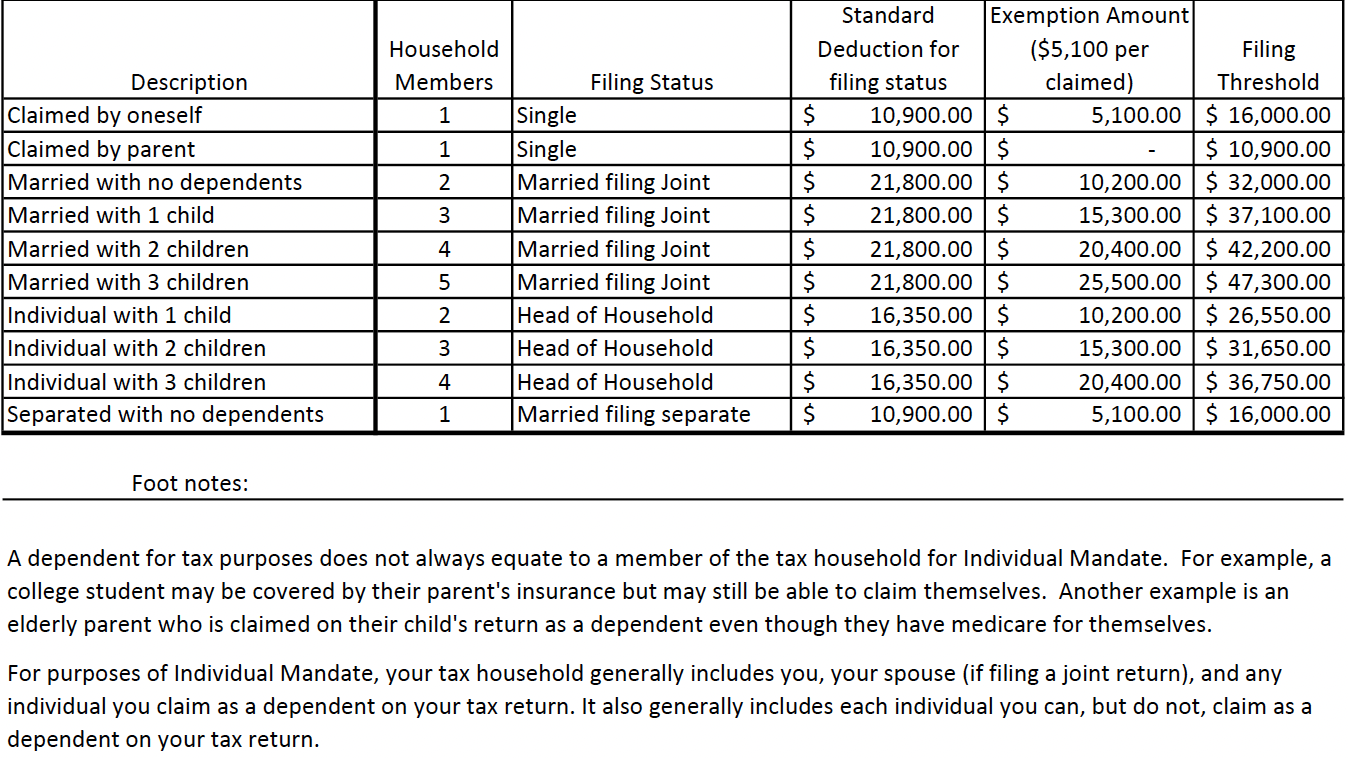

If your household income is lower than the tax filing threshold, your household is not required to pay a penalty for not having health coverage. When this is applicable, filers should claim code NC on the IND-HEALTH for the months in which they did not have insurance to avoid being assessed a penalty for those months. The tax filing threshold is the standard deduction for your filing status plus $5,100* per exemption.

As an example, a married couple filing jointly with 2 children (or dependents) would have a standard deduction of $21,800* plus $5,100* times 4 exemptions ($20,400*). The minimum for this family of would be $42,200*.

*Please note this example uses figures for the Tax Year 2025. Below is a chart you may reference for Tax Year 2025:

Where can I find more information about reporting requirements?

Please visit the RI Division of Taxation’s mandate information page to learn more about reporting requirements.

Need More Information?

For questions regarding eligibility for health coverage through HealthSource RI, and exemptions for hardship or religious conscience:

Contact HealthSource RI by using our live web chat or via phone at 1-855-840-4774. Our live web chat and call center are typically staffed Monday-Friday from 8:00 a.m. to 6:00 p.m., with extended hours (during Open Enrollment): Mon, Weds-Fri 8:00 a.m. – 6:00 p.m.; Tues 8 a.m. – 8 p.m.; Sat 9 a.m. – 12 p.m.

For questions related to the tax filing threshold calculations, or other Personal Income Tax related matters:

Please call the Rhode Island Division of Taxation at (401) 574-8829 Option 3 (three). The line is staffed from 8:30 a.m. to 3:30 p.m. business days. Or visit the Division’s website: www.tax.ri.gov.

Specific penalty information will be added in the near future. For tax planning or other individual tax advice, including how the penalty may affect your personal financial circumstances, please contact your tax preparer or tax advisor.

DISCLAIMER

These materials were prepared as a service to the public by the Rhode Island Division of Taxation and HealthSource RI (collectively, the “State”). Although every reasonable effort has been made to assure the accuracy of the information within these materials, the State makes no claims, guarantees or promises about the accuracy, currency, or completeness of the information provided and is not responsible for any errors or omissions, or for results obtained from the use of the information.

The information provided in these materials is only intended to be a general summary. It is not intended to take the place of either the written law or regulations. We encourage readers to review the specific statutes, regulations, and other interpretive materials for a full and accurate statement of their contents.

Nothing in these materials constitutes accounting, legal or tax advice. These materials are provided “as is” without warranty of any kind, whether express or implied.

HealthSource RI connects you with health and dental insurance from these companies: